RBA Recap

- RBA’s March meeting was the first under their new 6-week schedule, with no meeting in April, next one scheduled for May 7th.

- Despite unanimous expectations of no cash rate change, language shift in the statement suggests a move towards a neutral stance.

- Market anticipates cash rate to remain steady for most of 2024, with potential easing later in the year, dependent on employment and inflation data, likely not before November.

The Australian Economy

- Australian economy experiences prolonged softening with strained household incomes due to high inflation, tight monetary policy, and increased tax payments, leading to significant reductions in spending and savings.

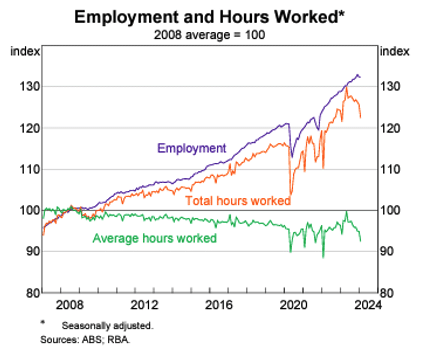

- Despite slower growth and persisting economic challenges, recent data shows unexpected strength in employment, with the unemployment rate dropping to 3.7%, well below economists’ projections, driven by a surge in job creation and high migration rates.

- While positive employment figures contrast with ongoing economic uncertainty, they present a dilemma for the Reserve Bank of Australia (RBA), potentially delaying projected rate cuts as they navigate between easing inflation and a robust labour market.

Please click here to download the March Monthly