RBA Recap

- RBA paused, keeping the cash rate at 4.10% for the month of July.

- The RBA faces difficult decisions ahead, failure to return inflation back to target means higher rates for longer. However, how much pain is enough to ensure targeted progress?

- The narrative needs to stay in control of the RBA to avoid consumer sentiment and demand running rampant.

The Australian Economy

- An easing in monthly inflation sees some reprieve potentially on the horizon as we approach quarterly CPI.

- Consumer sentiment was buoyed by falling inflation but tempered by ongoing RBA tightening bias.

Market Dynamics

- The dwindling of ES balances and a negative funding gap across the banking system continues to keep funds tight.

- This paired with EOFY liquidity target and balance sheet strengthening has seen a strong demand for funds.

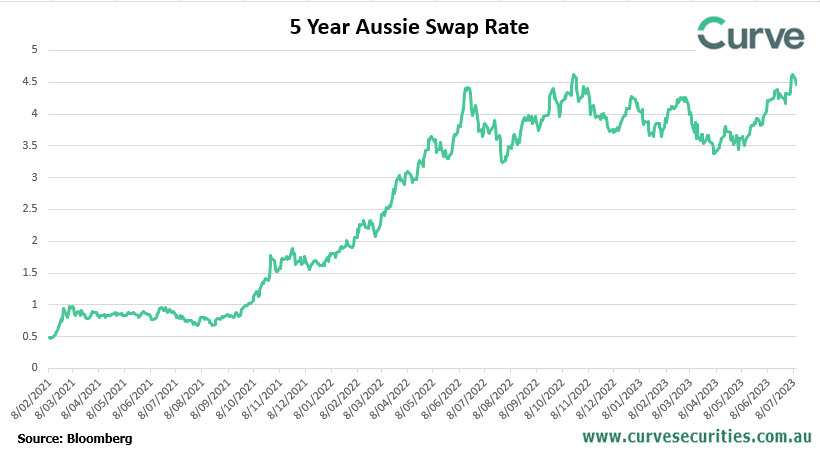

- Reference rates continue to climb slowly, with thin trading in interest rate markets making for dramatic price movements.

- Both demand for funds and increases in reference rates has favoured investors seize the opportunity lock in longer duration placements.

Please click here to download the July Monthly