Daily Flows

- Yesterday, there was a flow directed towards the Suncorp 3mBBSW +125 12/2027 bond, a stock that bears significant liquidity in the market.

- Term deposit margins for 1 year have narrowed to 80-85 bps from last year’s highs of 100-110. This tightening may reflect less strained liquidity conditions.

- As we approach the TFF repayment window, the departure of cheap funds from the system may lead to widening margins, benefiting investors.

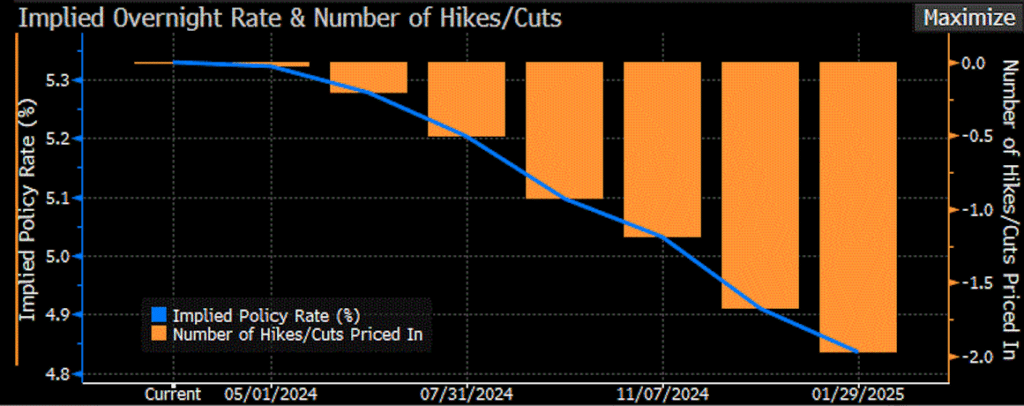

U.S. CPI Running Hot Pushes Out Cut Expectations

- Headline CPI rose by 0.38% in March, leading to a 12-month inflation increase to 3.5%, surpassing expectations and pre-pandemic norms.

- Energy prices, which were previously dragging down CPI inflation, swung positively contributing to the increase, while inflation outside of energy and food has gradually slowed.

- Prices for food away from home, a focal point, increased by 26bp in March, showing moderate growth compared to the significant slowing observed in February.

- This data combined with the Fed minutes led to declines in investor confidence, pushing out the expectation for the first rate cut to November and prompting a sell-off in equities.

- Bond yields surged after the data release, with the U.S. 10-year rising by 19 basis points to 4.55 and the 2-year climbing to 4.97.

- Domestic market participants should anticipate the Aussie yield curve to follow suit.