$7b

on deposit

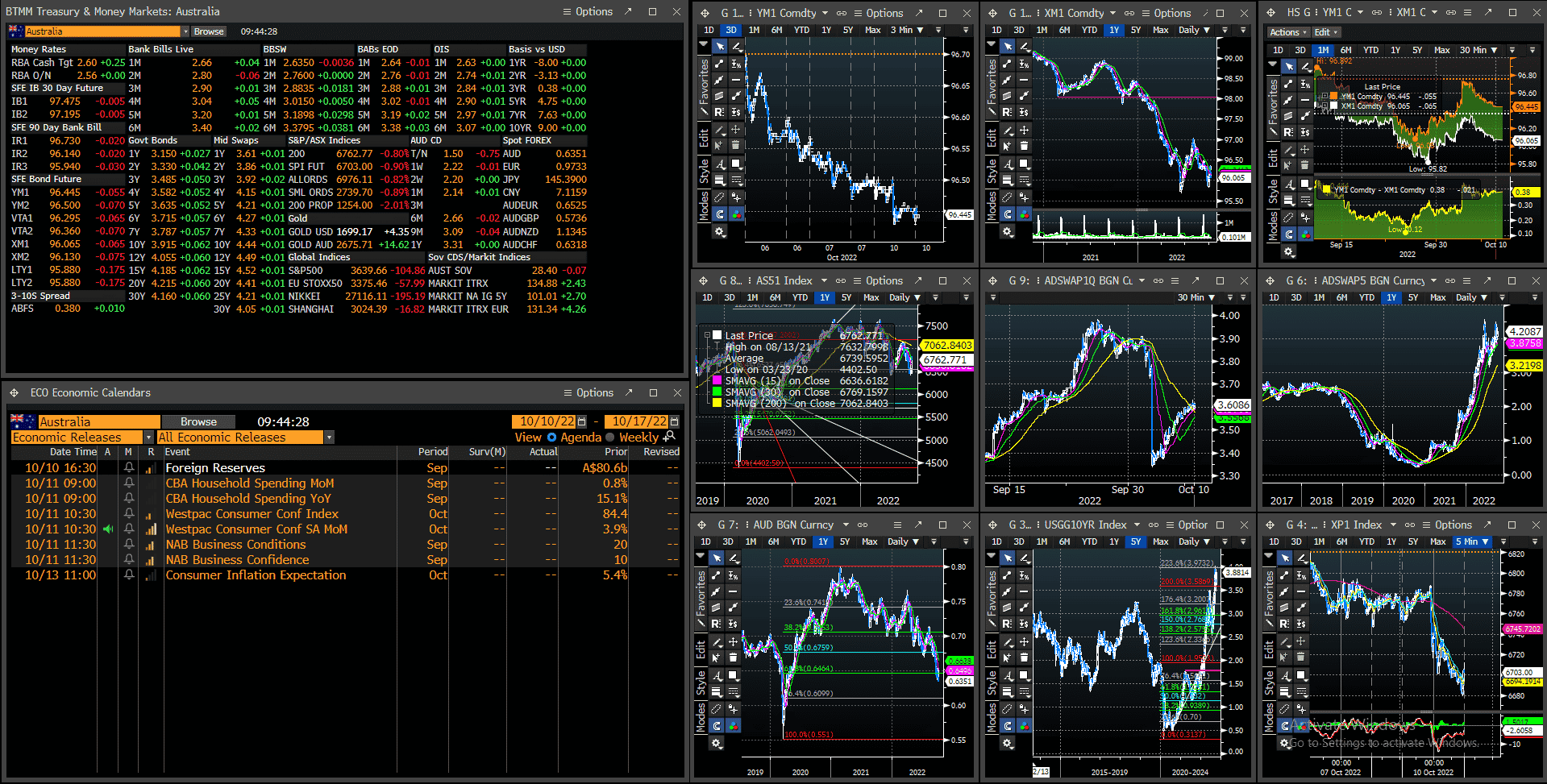

Curve currently has over $7 billion on deposit. We scour the markets to source deposit rates and terms that best match your investment ambitions at any given time. We work with over 80 banking partners across the whole credit spectrum from highly rated major banks to unrated credit unions. These are all brought together on our proprietary platform YieldHub.