RBA Recap

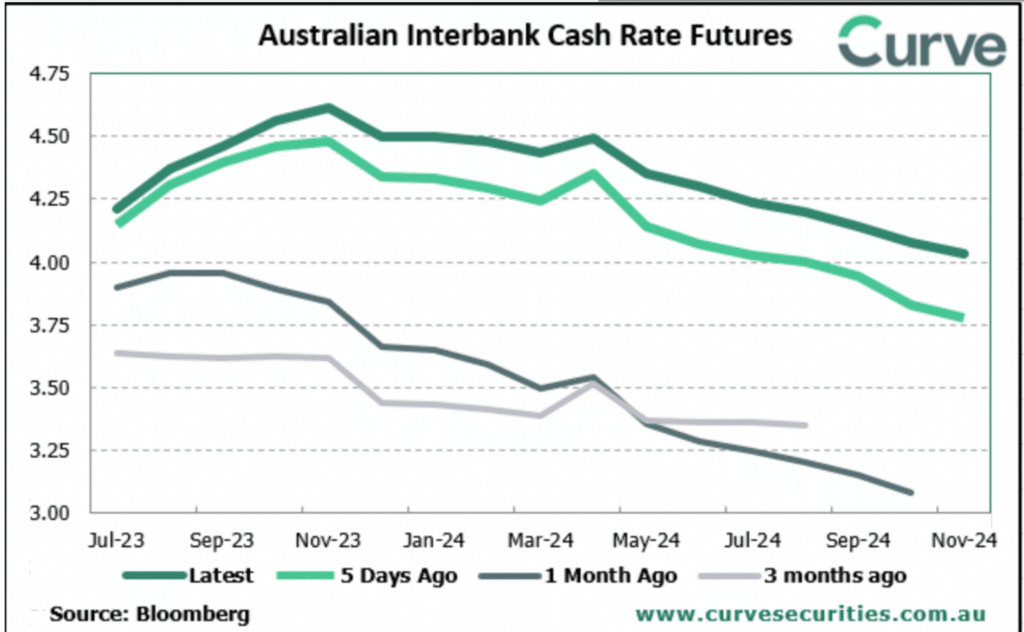

- RBA surprises markets and economists with their twelfth rate hike, taking the cash rate to 4.10%.

- It is becoming clear that the RBA is relying less on forecasting and rather dealing with the here and now.

- The RBA is still walking a narrow path but it appears to be narrowing.

The Australian Economy

- Whilst the Economy is showing signs of turning, it will be interested to see how the immigration story may feed into aggregate GDP.

- Consumer sentiment continues to remain at recessionary levels and the recently robust business conditions begin to enter negative territory.

- Despite this, the labour market is still showing resilience, fuelling RBA hawkishness to come.

Market Dynamics

- Demand for funds has remained persistent across the banking system since overseas liquidity concerns spooked regulators and liquidity risk managers.

- This paired with a winding down of pandemic RBA liquidity provisions and the recent surprise June hike has seen TD and NCD rates remain extremely elevated.

- As we near the peak of the rate hike cycle, how much longer will 5.50% and above Term Deposits be offered for?

Please click here to download the June Monthly